If their is one sector in which small investors should never invest for the long term than it is aviation sector. Famous investor and businessman Mr. Richard Branson had this to say about airlines.

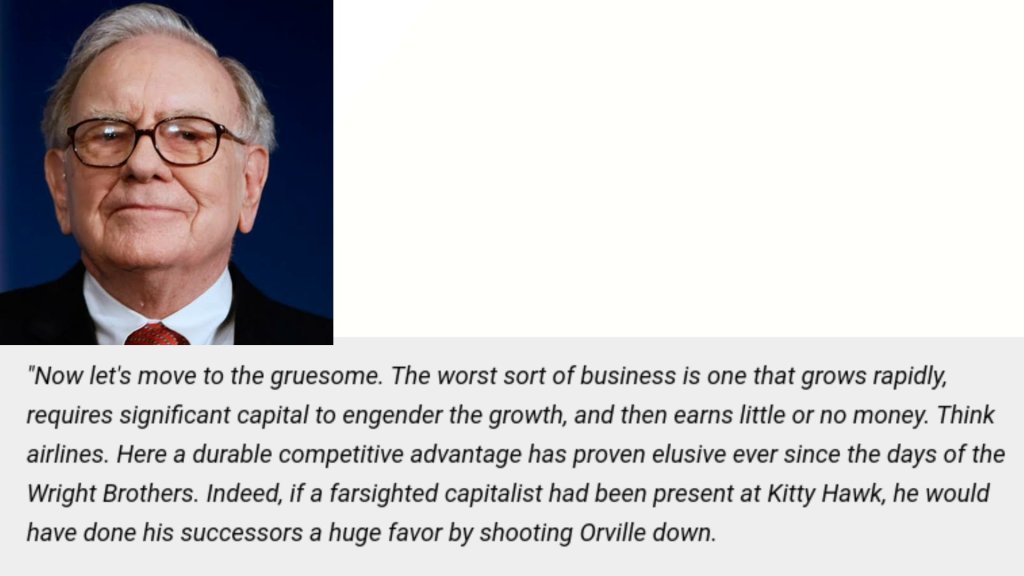

Mr Warren Buffet has also on several occasions spoken against investing in airlines stocks. Because this is one business which needs a large capital to start, than it has very high running expenses and after all this also most of the airlines earn little or no money.

Airlines stocks have a long history where investors have lost large sums of money because of airline companies failing and going bankrupt.

So what is it about airlines that it is considered one of the worst sectors for investing.

Now let us have a look at the history of airlines in Indian context. In india first time doors were opened for the private players in the 1980,s, and lot of Private companies entered the Indian market, But they could not stay in the market for long, and for various reasons most of them had to shut down operations.

If we talk about 2005 that is 15 years back than the top 3 domestic players in the Indian market were First was Jet Airways which had the maximum market share and it was one of the best companies to fly for a long time but jet also could not survive the competition and it shut down operations few years back.

Second in market share was Indian Airlines, which was later merged in Air India, and the combined entity today is running in deep losses, it is only surviving because it is a government company and Indian taxpayers are funding it. Government is trying to sell it from some time but so far they have not been successful in finding a suitable buyer for Air India

Third in market share was Sahara airlines, which also ran into trouble and was later merged with Jet airways. So all three market leaders in 2005 are nowhere now. Besides them many big and small airline companies have shut shop in India.

And this is not limited to India, If we look at America than in last many decades, more than 100 airlines companies have gone bankrupt giving severe losses to its investors.

Many people wonder that Airline is such a fast growing sector in India with more and more people turning to flying, than how is it that with so many people flying than also Airlines are running in deep losses.

The reasons are many First of all it is a very high Capital intensive sector, and huge investments are required for starting and running an airline.High aircraft costs, salaries for employees, high expenses in oil cost, taxes etc.

Then none of the operators is manufacturing its aircraft, they are all purchasing their aeroplanes from same manufacturers. Since they are not in aircraft manufacturing developing a more cost efficient aircraft for themselves to outdo the competition is not a possibility.

Lack of Infrastructure in the country also increases the costs for the airlines, as the airports have become so congested that many a times flights are unable to land on time, they get delayed and all of this adds up to airlines costs. Another problem with airlines is their high dependence on crude which forms a major chunk of their costs. So if the crude prices rise the thin margin the airlines are operating on evaporates making it very difficult for them. Corona pandemic has also hit the aviation sector very hard and this shows how vulnerable aviation sector is to external factors .

Next comes the cut throat competition in the Indian market. All airline companies are competing with each other to gain market share, and the only way to stay ahead of the competition in this price conscious Indian market is by offering cheaper fares. Low cost airlines like Indigo, Spicejet have lowered the air fares to such a level and are working on such low margins that it has become very difficult for other airlines to survive in the Indian aviation sector. Even the low cost airlines,though they have gained market share but their Financial condition remains weak because of very low profitability.

Another thing which is crucial to many businesses is Customer loyalty which is not their in the Airlines sector , as the passenger is only interested in the cheapest air ticket, and it does not matter to him whether he is flying in X airlines or Y airlines.

Airlines do not have this option available to them to cancel the flight or send a smaller aircraft if very few passengers have booked tickets.This also adds to airlines losses.

Then they have to fly on some unprofitable routes also so as to comply with the government regulations and this also adds to losses.

Now they try to cover up their losses when the peak season comes, like diwali, newyear etc by raising their airfares but here again the government comes into picture and caps the airfares to a value beyond which they can not price their tickets. While govt is trying to safeguard the interests of the passengers but this takes away from the airline the chance they had to earn a decent profit.

Airline operators have already invested a lot of money in their businesses ,so shutting down operations is not an option for them and slowly the losses keep piling up and a stage comes when the operator is not left with any other option but to look for a buyer for his airlines or file for bankruptcy.

Now to invest in airlines shares or not is a decision which each investor needs to take in consultation with his financial advisor, but here i have listed a few points which i feel are essential and needs to be taken into account which making a decision of investing in airlines stocks.

So their are a large no. of factors why the airline stocks are not able to perform well , and investors should be very cautious while investing in them.It requires deep study and knowledge to decide on the correct entry and exit time from these airlines stocks.

Bhaskar Sankhla

Disclaimer – Views expressed are author,s own. Please take your own decision for investing in consultation with your financial planner.